Macro

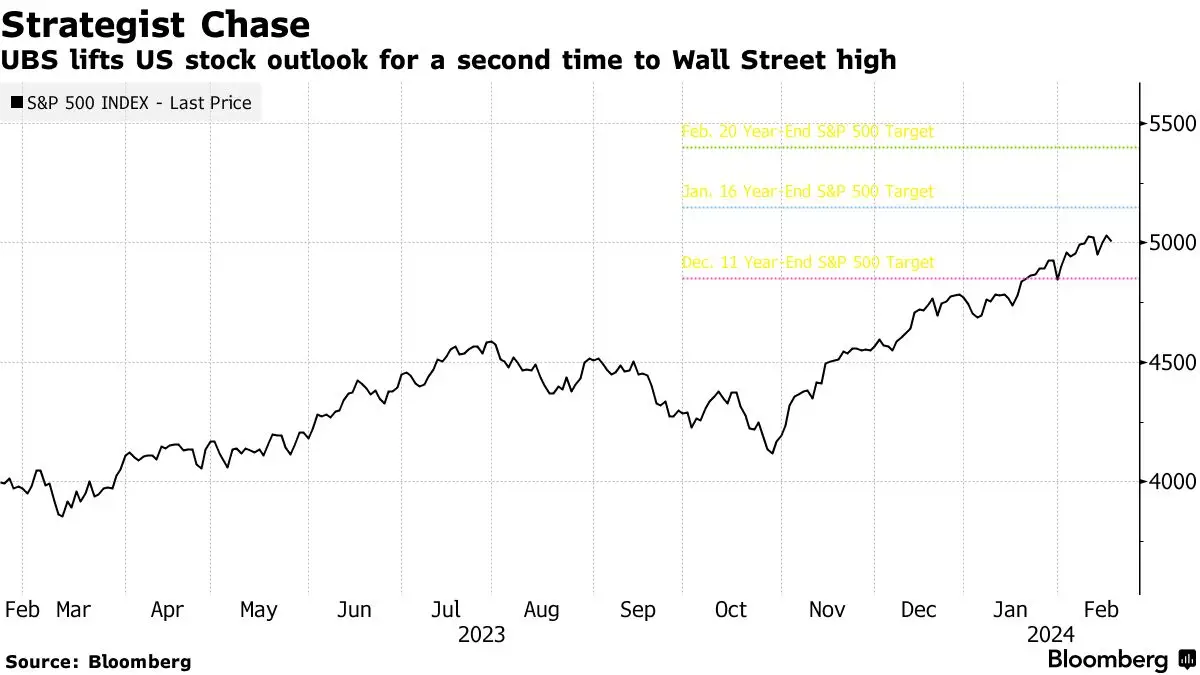

UBS's S&P 500 Forecast Hits 5,400: A Bullish Economic Bet

UBS Sets S&P 500 Target at 5,400 for End of 2024, Reflecting Economic Optimism and Sectoral Adjustments

By Bill Bullington

ᐧ

Key Takeaway

- UBS upgrades its S&P 500 year-end forecast to 5,400, marking an 8% potential upside and aligning with the most bullish Wall Street predictions.

- The revision reflects confidence in a sturdy economy and positive inflation data, alongside increased earnings expectations for 2024 and 2025.

- Shifts to overweight on financials and neutral on healthcare suggest a strategic pivot towards cyclical sectors amid anticipated higher interest rates and M&A activity.

UBS's Bold Leap: Elevating the S&P 500 Forecast Amidst Economic Optimism

In a move that has captured the attention of investors and market analysts alike, UBS Group AG has boldly revised its year-end forecast for the S&P 500 Index, setting a new target of 5,400 by the end of 2024. This represents an ambitious 8% potential upside from its recent close, placing UBS at the forefront of Wall Street's bullish brigade. The upward revision by strategists Jonathan Golub and Patrick Palfrey is not merely a number game; it's a reflection of UBS's confidence in the resilience of the economy and the favorable inflation landscape, which they believe will continue to bolster equity prices.

A Closer Look at the Market Dynamics

The optimism from UBS comes at a time when the market has experienced volatility due to unexpected inflation data. However, UBS's analysis suggests that the underlying demand-driven economic indicators remain strong, painting a positive picture for future equity returns. This bullish outlook is further supported by UBS's upgraded earnings forecasts for the S&P 500, with projections of earnings per share rising to $240 in 2024 and $255 in 2025. Such adjustments are indicative of a robust economic outlook that could potentially fuel market gains.

Sectoral Shifts and Strategic Recommendations

In addition to its optimistic market forecast, UBS has also recalibrated its sector recommendations, now favoring financials. This shift is attributed to the anticipated benefits from higher interest rates and a potential uptick in mergers and acquisitions activity. This strategic pivot underscores UBS's nuanced understanding of market dynamics and its ability to adapt its investment strategies to evolving economic conditions.

The Broader Wall Street Sentiment

UBS's revised forecast is part of a larger trend among Wall Street firms, who are increasingly revising their S&P 500 targets upwards. This collective optimism is driven by advancements in artificial intelligence and evolving expectations around monetary policy. Notably, Bank of America Corp., through its strategist Savita Subramanian, has also hinted at a possible upward adjustment to its year-end target. Despite these revisions, the average target among sell-side strategists still trails behind the current market level, suggesting a potential underestimation of the market's growth trajectory.

Navigating the Future

UBS's latest forecast not only underscores the firm's bullish stance but also signals a broader reassessment of equity market prospects among major financial institutions. As we navigate through the complexities of the market, the insights from UBS offer a compelling narrative of optimism, backed by a thorough analysis of economic indicators and sectoral trends. For active investors in the US markets, these developments provide a valuable perspective, guiding investment strategies in a landscape marked by both opportunities and uncertainties.

In essence, UBS's bold forecast for the S&P 500 is more than just a number; it's a testament to the firm's confidence in the market's resilience and growth potential. As we move closer to 2024, it will be interesting to see how these predictions unfold and what implications they hold for investors and the broader market.

Street Views

Jonathan Golub and Patrick Palfrey, UBS (Bullish on the S&P 500):

"Despite our bullish outlook, it appears we were not bullish enough... our work indicates these demand-driven readings are constructive for future returns."

Savita Subramanian, Bank of America Corp. (Cautiously Optimistic on the S&P 500):

"The firm’s target is probably too low in the near-term."

Finance GPT

beta