Macro

Amazon, Mastercard, Equinix Set for Gains with Analysts' Support

Over 160 S&P 500 companies, including Amazon and Mastercard, set to report with high analyst optimism and earnings momentum.

By Bill Bullington

ᐧ

Key Takeaway

- Amazon, Mastercard, and Equinix are highlighted as stocks with strong earnings momentum and analyst support, suggesting potential post-earnings valuation increases.

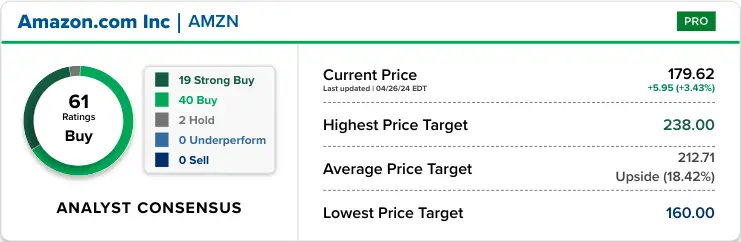

- Amazon's EPS estimates surged by 139% and 309% over three and six months with a 31% upside potential; shares up 18% YTD.

- Mastercard's earnings estimates rose by 12% to 20%, with an expected rally of 18%; Equinix has an 11% rally potential despite a 9% YTD drop.

Earnings Season Momentum

As we approach the halfway mark of the first quarter earnings season, Wall Street's gaze intensifies on the performance of its darlings, with more than 160 S&P 500 companies slated to report their results in the coming week. This period is not just another earnings season; it's a litmus test for the market's resilience amidst macroeconomic headwinds. So far, the season has been promising, with 77% of companies surpassing analyst expectations, a testament to the underlying strength of Corporate America.

Among the stocks to watch, Amazon and Mastercard stand out with significant earnings momentum and analyst optimism. Amazon, with its earnings estimates up by 139% and 309% over three and six months respectively, is anticipated to see a 31% upside, buoyed by its efficient operations and burgeoning AWS demand. Mastercard's earnings estimates have also seen a healthy uptick, with a potential 18% rally on the horizon, reflecting confidence in its growth trajectory.

Analysts' Picks Highlight Growth Potential

The spotlight shines on a select group of companies poised for post-earnings valuation surges, identified through a meticulous CNBC Pro screening. These companies, including AES Corp, American Tower Corp, and Equinix, have not only seen upward revisions in their earnings estimates but also enjoy a strong buy consensus among analysts. This blend of earnings momentum and market confidence underscores the potential for significant market movements in the week ahead.

Equinix, despite a year-to-date dip, is forecasted for an 11% rally, illustrating the market's forward-looking nature. Analysts' bullish stance on these stocks, backed by robust earnings revisions and attractive price targets, signals a broader market optimism, potentially setting the stage for notable gains.

Historical Performance as a Beacon

The analysis by Bespoke Investment Group sheds light on stocks with a history of outperforming post-earnings expectations, offering a glimpse into potential market movers. Companies like HubSpot and Wingstop, with their impressive track records of earnings beats and subsequent gains, highlight the opportunities for discerning investors. This historical lens, combined with current analyst sentiment, provides a nuanced view of the market's potential direction, emphasizing the importance of past performance in forecasting future movements.

Street Views

Citi Analyst Ronald Josey (Bullish on Amazon):

"Given faster shipping speeds, we believe conversion rates are improving as Amazon’s retail business benefits from its regionalization approach with shorter transport distances as the overall cost to serve comes down. While on AWS, demand for new instances appears to be improving, led by GenAI, as optimizations wane."

TD Cowen Analyst Bryan Bergin (Bullish on Mastercard):

"Mastercard has seen earnings estimates rise by 12% in the past three months, and 20% over the past six months. Average analyst price targets show that the stock could rally 18%."

Finance GPT

beta