Equities

Nvidia's Earnings Report Generates Market Buzz and High Expectations

Goldman Sachs labels Nvidia as pivotal, with its earnings report poised to significantly impact market volatility and AI sector insights.

By Alex P. Chase

ᐧ

Key Takeaway

- Goldman Sachs labels Nvidia as "the most important stock on planet earth," with an expected 11% volatility around its earnings report.

- Nvidia's role in AI revolution and tech sector's focus on AI infrastructure spending underscore its market significance.

- Financial projections for Nvidia show $20.01 billion in Q4 revenue and EPS of $4.48, highlighting the high expectations from its performance in AI and tech innovation.

Market Anticipation

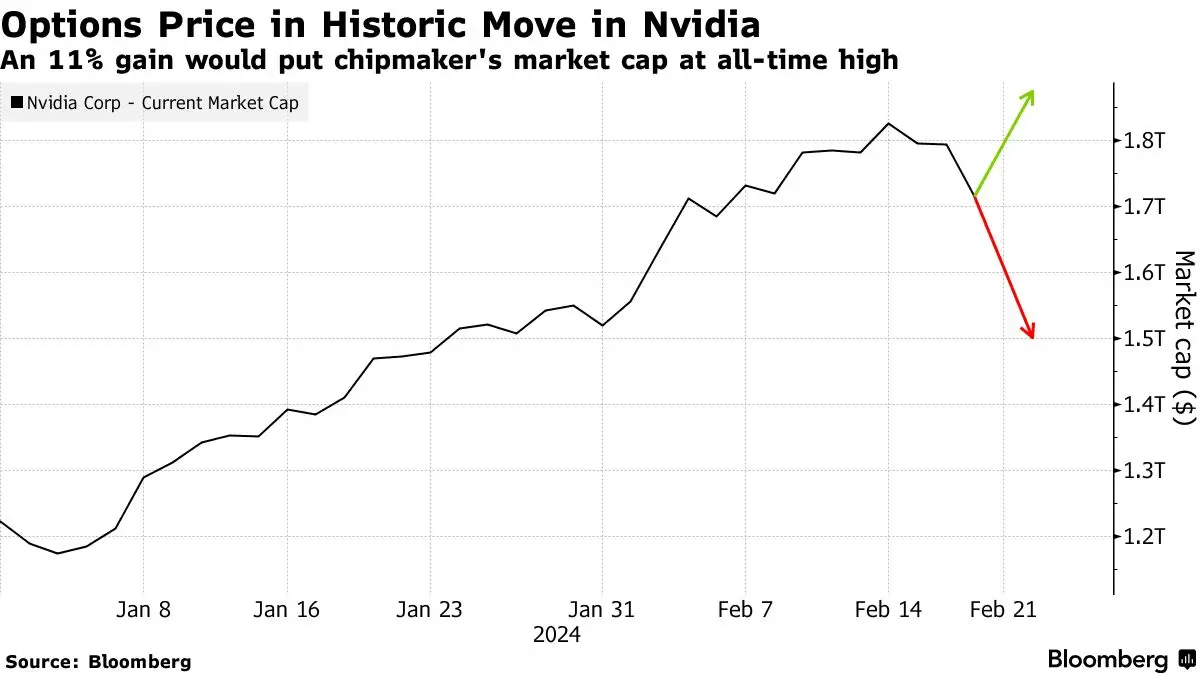

Nvidia Corp.'s upcoming earnings report is generating significant buzz in the market, with Goldman Sachs Group Inc. dubbing it "the most important stock on planet earth." The options market is pricing in an approximately 11% move in either direction, indicating potential volatility. Nvidia's substantial weight in indexes and the prevalence of crowded long positions in the stock make it a key player in the market. The stock's recent surge, tripling in value over the past year, has heightened expectations for the earnings report.

"Everyone is in the pool and there are positioning warning signs," noted Goldman's Scott Rubner, highlighting the high expectations for Nvidia's performance. The stock's recent decline of 4.4% has added to the nervousness surrounding the upcoming earnings release.

AI Revolution and Tech Landscape

The onset of 2024 has sparked discussions among investors regarding the monetization of the AI Revolution, drawing parallels to the emergence of the Internet in 1995. Major tech giants like Microsoft, Alphabet, Meta Platforms, and Amazon have shown an increased focus on capital expenditure towards AI infrastructure, signaling the beginning of AI monetization within the tech sector. Nvidia, known as a pioneer in AI, is expected to provide valuable insights in its upcoming earnings report, with investors eagerly awaiting its performance and outlook.

Analysts are particularly interested in Nvidia's data center AI spending pace, as the company remains a key player in providing GPUs for generative AI applications. Despite concerns over valuations, investors recognize the transformative potential of tech giants like Nvidia, Microsoft, and others in shaping the future through AI innovation.

Financial Projections and Expectations

Wedbush analyst Matt Bryson projected fourth-quarter revenue and EPS of $20.01 billion and $4.48 for Nvidia, citing continued momentum in AI infrastructure spending and high demand for High Bandwidth Memory (HBM). Nvidia is expected to be the largest consumer of these components in 2024. The company's performance in the upcoming earnings report will provide crucial insights into the tech sector and broader markets, with a focus on GPU orders and demand trends from enterprises.

Street Views

- Scott Rubner, Goldman Sachs (Neutral on Nvidia):

"Everyone is in the pool and there are positioning warning signs. The bar is high, and by high I mean a big beat is expected."

Finance GPT

beta