Macro

Amazon's Dow Debut Marks New Era for US Economy

Amazon's Entry into Dow Jones Marks a New Era, Reflecting the Growing Influence of Tech and Consumer Retail in the US Economy

By Athena Xu

ᐧ

Key Takeaway

- Amazon to join Dow Jones Industrial Average, replacing Walgreens, effective Feb. 26, reflecting the evolving American economy.

- The change follows Walmart's 3-to-1 stock split, adjusting its index weight while maintaining its position in the Dow.

- Uber replaces JetBlue in the Dow Jones Transportation Average, marking a shift towards ride-sharing industry exposure.

Amazon's Strategic Leap into the Dow Jones Industrial Average: A New Era for US Equities

In a landmark move that underscores the shifting sands of the American economy, Amazon.com Inc. is poised to make its grand entrance into the Dow Jones Industrial Average (DJIA), effectively replacing Walgreens Boots Alliance Inc. This significant transition, announced by S&P Dow Jones Indices after the market closed on Tuesday, is set to take effect at the opening bell on Monday, Feb. 26. The catalyst for this change is attributed to Walmart Inc.'s decision to execute a 3-to-1 stock split, which, while altering its weight, allows it to maintain its prestigious spot within the DJIA. Amazon's inclusion is not merely a procedural update; it is a vivid illustration of the evolving dynamics within the U.S. economy, spotlighting the burgeoning influence of the consumer retail and technology sectors.

Art Hogan, a seasoned market strategist at B. Riley Wealth, encapsulated the sentiment surrounding Amazon's inclusion, stating, "Amazon's entry is emblematic of the U.S. economy's current state, ensuring the index remains reflective of the consumer-facing companies that dominate today's market landscape."

Market Dynamics Post-Announcement

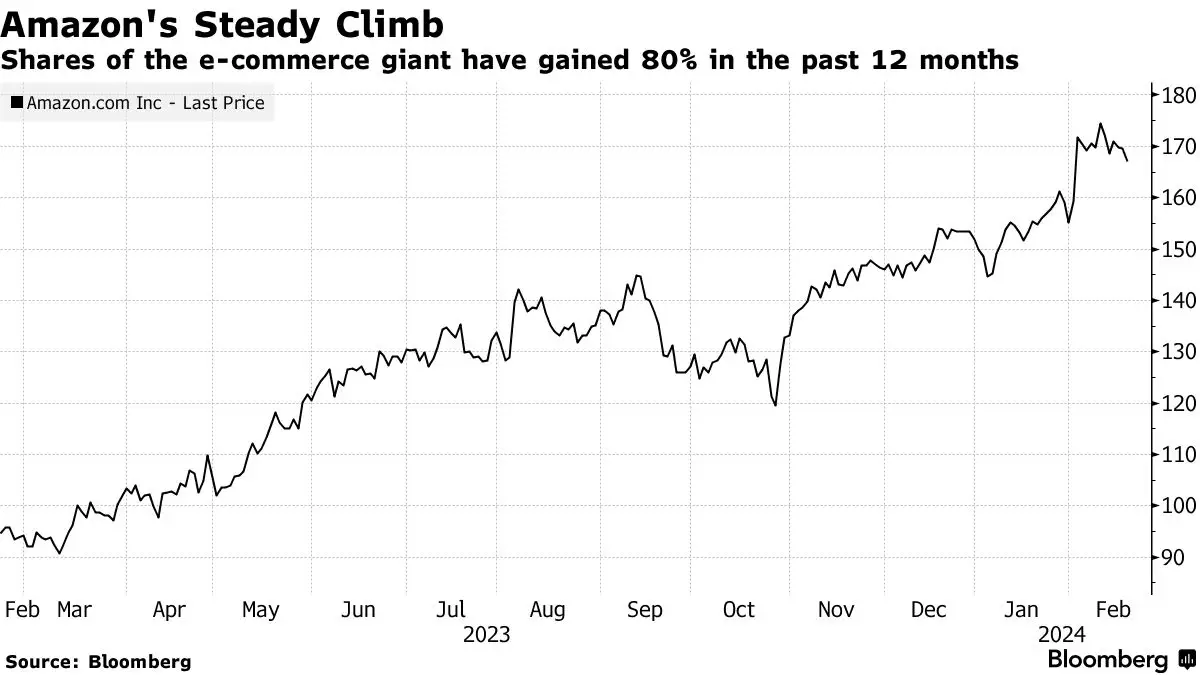

The ripple effects of this announcement were immediately felt in the market. Amazon's stock experienced a 1.5% uptick in extended trading, signaling investor optimism about the e-commerce giant's new status. Conversely, Walgreens saw its shares dip by over 3%, a reaction that underscores the competitive pressures and market cap considerations that influence Dow compositions. In tandem with these changes, the Dow Jones Transportation Average is also undergoing a transformation, welcoming Uber Technologies Inc. in place of JetBlue Airways Corp. This adjustment, which saw Uber's shares climb by 1%, reflects a broader embrace of modern industry models, such as ride-sharing, within traditional market indices.

A Mirror to the American Economy's Transformation

The inclusion of Amazon in the DJIA, alongside Uber's addition to the Dow Jones Transportation Average, transcends mere index reshuffling. It is a testament to the profound metamorphosis of the U.S. economy. From its origins as a humble online bookstore, Amazon has burgeoned into an e-commerce and cloud computing colossus, claiming the title of the second-largest private employer in the nation. This strategic index realignment acknowledges the critical role of technology and service-oriented industries in sculpting contemporary economic and market trajectories.

As the Dow Jones Industrial Average continues to evolve, its composition offers a panoramic view of the shifting tides in sectoral dominance and economic priorities. The inclusion of Amazon and Uber not only reflects the current economic zeitgeist but also signals the Dow's enduring relevance as a barometer for industry trends and corporate giants' ascendancy in the American economy. This pivotal moment marks the dawn of a new era in U.S. equities, one where innovation, technology, and consumer services are at the forefront, steering the economy into future horizons.

Street Views

- Art Hogan, B. Riley Wealth (Neutral on the Dow Jones Industrial Average):

"It certainly has been a long time coming for a major change in the Dow Jones Industrial Average. If any company represents the US economy better than Amazon, I don’t think we found it yet. It replaces another consumer facing company, so the balance of the index remains the same."

Finance GPT

beta