Macro

Short-Volatility Trades Surge, Echoes of 2018 Loom

Resurgence of Short-Volatility Trading Raises Market Stability Concerns Amid Rising VIX and S&P 500 Gains

By Barry Stearns

ᐧ

Key Takeaway

- Short-volatility trades, reminiscent of the 2018 "Volmageddon," have surged, raising concerns of potential market selloffs amid rising VIX and S&P 500.

- Derivative-income funds' assets grew from $8 billion in January 2021 to $72 billion by end of last year, increasing short-vol exposure.

- The dispersion trade's popularity in 2023 signals a crowded market, with a significant rise in "short vega" exposure since January 2018.

Navigating the Tightrope: The Return of Short-Volatility Strategies and Market Equilibrium

In the financial markets, history often rhymes, if not repeats. The resurgence of short-volatility trading, a strategy that once precipitated the infamous 2018 "Volmageddon," is stirring the pot once again, drawing a keen eye from derivatives-market aficionados. This strategy's comeback, marked by its most robust performance in six years, is not just a tale of risk and return but a nuanced narrative of investor sentiment and market dynamics.

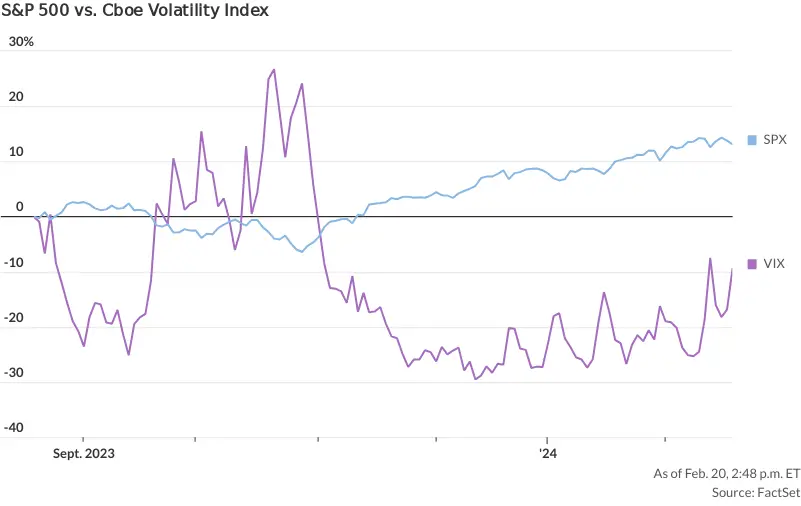

As we stand at the crossroads of market optimism and caution, the Cboe Volatility Index (VIX), often referred to as the market's "fear gauge," has ascended 12.7% to 15.5 since December 1. Concurrently, the S&P 500 has notched an 8.9% increase to 4,978, painting a picture of a market walking a tightrope between growth and uncertainty. This juxtaposition of a rising VIX alongside a buoyant S&P 500 underscores a burgeoning demand for portfolio insurance, a testament to the market's undercurrent of apprehension. The anticipation surrounding Nvidia Corp.'s earnings report and the historical volatility of February market performance further accentuate this cautious sentiment.

The Transformation of Short-Volatility Vehicles

The aftermath of Volmageddon has reshaped the terrain of leveraged short-volatility products. The pivot has been towards derivative-income funds, which have witnessed a meteoric rise from under $8 billion in January 2021 to a staggering $72 billion by the end of the previous year. These funds, known for their strategy of selling calls or cash-secured puts, are perceived as less hazardous owing to their covered positions and the absence of leverage. Yet, the burgeoning of these funds, coupled with the advent of the dispersion trade—a strategy that gambles on the variance between implied volatility on the S&P 500 index and that of individual heavyweight stocks—has been instrumental in dampening VIX levels, potentially laying the groundwork for market turbulence.

The Complex Web of Market Dynamics

The market's growing penchant for short-volatility exposure, fueled by derivative-income funds and intricate strategies like the dispersion trade, is casting a long shadow over the prospects of a market correction. The recent uptick in the VIX, triggered by an inflation report that surpassed expectations, serves as a stark reminder of the market's vulnerability to volatility expiration days and the delicate equilibrium of the short-vol trade. Although the specter of a Volmageddon-scale debacle seems unlikely, thanks to more defined risk trading practices, the significant increase in nominal "short vega" exposure—up 2.5 times since January 2018—unveils the intricate tapestry of market dynamics and the looming potential for substantial volatility in response to pivotal economic reports and market trends.

In navigating the tightrope of today's financial markets, investors and market watchers alike must tread with caution and keen insight. The resurgence of short-volatility trading, while a sign of market evolution, also serves as a harbinger of the delicate balance between risk and reward. As we delve deeper into this narrative, it becomes clear that understanding the underpinnings of market sentiment and dynamics is crucial for those looking to navigate the ever-changing landscape of US equities and sectors.

Street Views

Mandy Xu, Cboe Global Markets (Neutral on the short-volatility trade):

"While these funds short volatility by selling options, their positions are covered and well-hedged. They also don’t typically employ leverage, leaving them less exposed to a sudden spike in volatility."

Kris Sidial, Ambrus Group (Cautiously Optimistic on the dispersion trade):

"The complicated strategy involves using a basket of options to short implied volatility on the S&P 500 index, while betting that implied volatility on a handful of the largest stocks in the index will continue to climb."

Michael Purves, Tallbacken Capital Advisors (Cautiously Optimistic on market conditions):

"This trade feels like it’s gone too far... If you look at these metrics where implied correlations are, they’re all telling you the same story, that correlation is near record low levels. Those are usually not sustainable."

Tom Essaye, Sevens Report Research (Bullish on short-volatility returns):

"Aside from a couple of brief spikes, the VIX generally trended lower in 2023 resulting in a 78% return for the ProShares Short VIX Short-Term Futures ETF SVXY. That is the best annual return for the short-volatility strategy since 2017."

Finance GPT

beta