World Wide

European 'Super 7' Stocks Identified for Growth Potential by Citi

Citi highlights 'Super 7' European stocks with growth potential, driving 45% of market gains this year.

By Bill Bullington

ᐧ

Key Takeaway

- Citi identifies 'Super 7' European stocks with growth potential, including Novo Nordisk and ASML, trading at cheaper valuations than U.S. counterparts.

- These stocks have driven 45% of Europe's equity market gains this year, outpacing the historical average significantly.

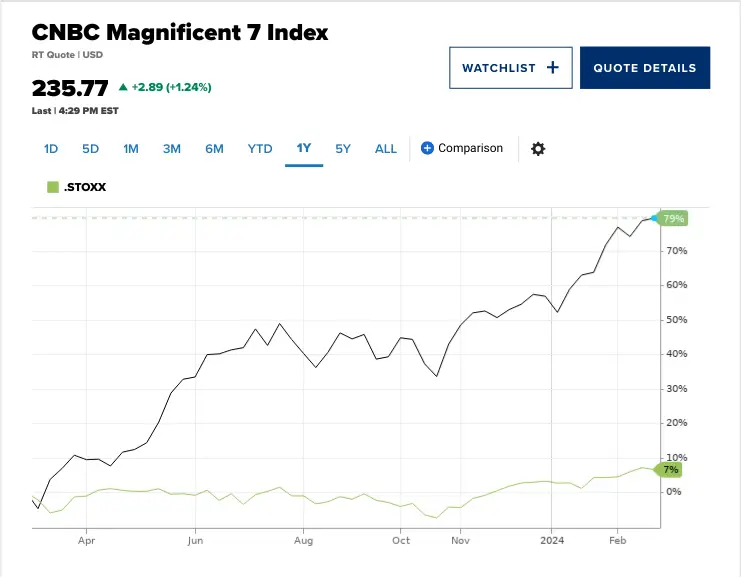

- Despite their current underperformance compared to the U.S. 'Magnificent 7', Citi sees significant upside for these European heavyweights.

European Equities Rally

The European stock market rally has been highlighted by a concentrated surge in a select group of stocks, reminiscent of the high-flying U.S. technology stocks. Citi, in a note to clients, introduced the 'Super 7', large-cap European stocks with similar fundamental characteristics to the U.S. 'Magnificent 7', but trading at cheaper valuations, indicating potential for further growth. The top five stock contributors in Europe have been driving 45% of equity market gains this year, a significant increase from the historical average of 25%.

Citi's Super Seven Picks

Citi's selection of European heavyweights, including Novo Nordisk, ASML, LVMH, SAP, Schneider Electric, Richemont, and Ferrari, have shown strong performance metrics such as high-profit margins, solid earnings-per-share growth, and competitive advantages. Despite lagging behind the U.S. Magnificent Seven in terms of appreciation since early 2023, these stocks present significant upside potential, as indicated by consensus analyst targets.

Market Outlook and Recommendations

Citi believes that the Super Seven are well-positioned to continue outperforming in the current 'narrow' market conditions. The bank advises against selling stocks solely based on narrow market leadership, suggesting that cyclical stocks and broader market indexes could see upside over the medium term if economic growth broadens out. The European equities market, with its concentrated rally and potential for further growth, presents opportunities for investors to capitalize on the momentum.

Street Views

- Citi Strategists led by Beata M. Manthey (Bullish on the "Super 7" European stocks):

"We introduce a group of European heavyweights, the ‘Super 7’, which have lagged the US Magnificent 7 but have similar fundamental characteristics... These could be beneficiaries in a continued ‘narrowing’ environment."

Finance GPT

beta