Equities

Nvidia Earnings Ignite Chip Stock Rally, AI Focus Sharpens

Nvidia's earnings beat propels chip stocks, as Fed's rate cut caution and China's market support measures draw investor focus

By Bill Bullington

ᐧ

Key Takeaway

The Asian equity futures market is mixed after Nvidia Corp. exceeded earnings estimates, boosting chip stocks in after-hours trading. Investors are closely watching chip and AI-related stocks as Nvidia's results are seen as a catalyst for market sentiment. Treasuries sold off, pushing the 10-year yield higher, following caution from the Federal Reserve about cutting rates. China's efforts to support its financial markets are in focus, with restrictions on major institutional investors and increased monitoring of short selling.

Nvidia's Strong Earnings Boost Chip Stocks

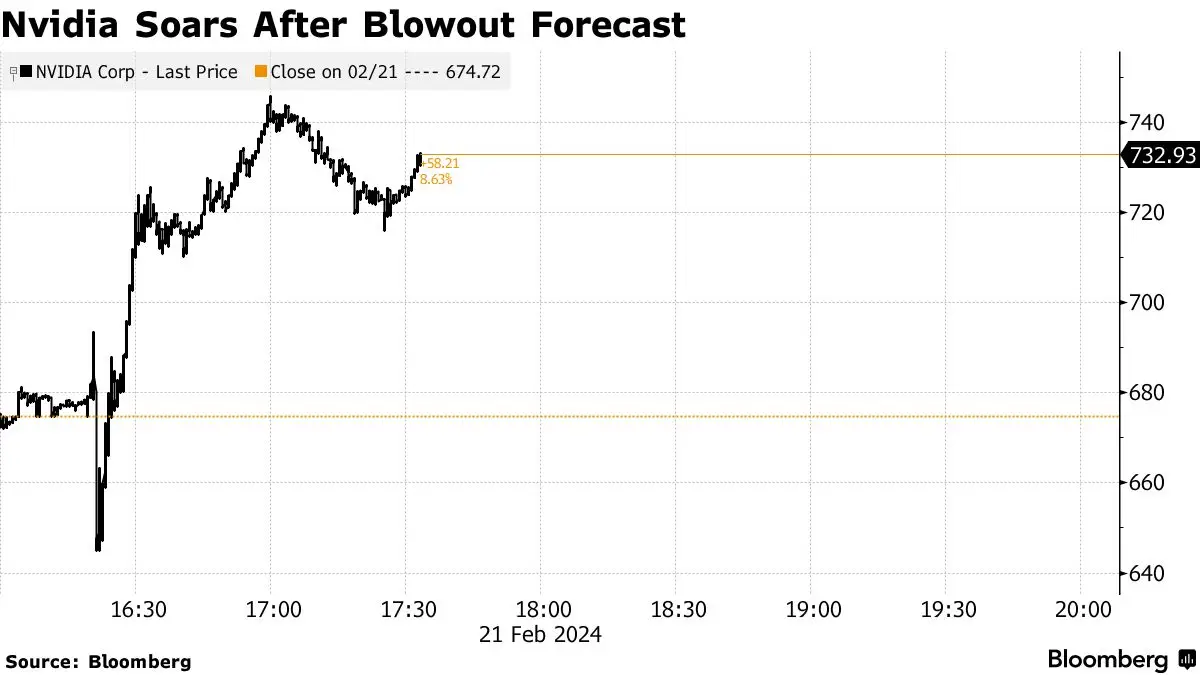

- Nvidia Corp. exceeded earnings estimates, with shares rising as much as 11% in post-market trade.

- First-quarter revenue is expected to hit $24 billion, above prior estimates of around $22 billion.

- Contracts for Japanese benchmarks rose, while those for Hong Kong fell. Futures for the Nasdaq 100 index rallied late Wednesday, spurred on by Nvidia results.

- Kim Forrest, chief investment officer of Bokeh Capital Partners LLC, noted, "As goes Nvidia, so goes the market," highlighting the importance of Nvidia to US benchmarks.

Treasuries Sell Off, Caution from Federal Reserve

- Treasuries sold off, pushing the 10-year yield five basis points higher.

- Federal Reserve meeting minutes revealed caution about cutting rates, with Fed Governor Michelle Bowman pushing back against the prospect of imminent cuts.

- Richmond Fed chief Thomas Barkin highlighted persistent pricing pressures in sectors such as housing despite falling headline inflation.

- Australian and New Zealand bonds tracked the declines in Treasuries.

China's Efforts to Support Financial Markets

- China has banned major institutional investors from reducing equity holdings at the open and close of each trading day, with increased monitoring of short selling.

- The Golden Dragon index of US-listed Chinese shares rose almost 1% in New York, following gains for mainland and Hong Kong shares.

- Economic reports in Asia include Hong Kong inflation, China Swift yuan payments, Indonesia’s fourth-quarter current account balance, and a monetary policy decision in South Korea.

- Later Thursday, data set for release includes Eurozone inflation and PMIs, as well as US initial jobless claims and home sales.

Street Views

- Kim Forrest, Bokeh Capital Partners LLC (Bullish on the market):

"As goes Nvidia, so goes the market... And it looks like the results are good enough. It does confirm the narrative that AI is going to continue to be strong for the foreseeable future. This narrative supported the markets last year, why wouldn’t it do the same this year?"

Finance GPT

beta