Equities

Investor Interest in AI Stocks Surges After Nvidia's Disclosure

Nvidia's disclosure ignites rallies in AI-linked stocks Nano-X and SoundHound AI, spotlighting the market's AI enthusiasm.

By Alex P. Chase

ᐧ

Key Takeaway

- Nvidia's disclosure led to Nano-X doubling and SoundHound AI surging 69%, spotlighting intense investor interest in AI-related stocks.

- Nvidia's stock quadrupled since end of 2022, reaching a $1.7 trillion market cap, with its earnings update highly anticipated.

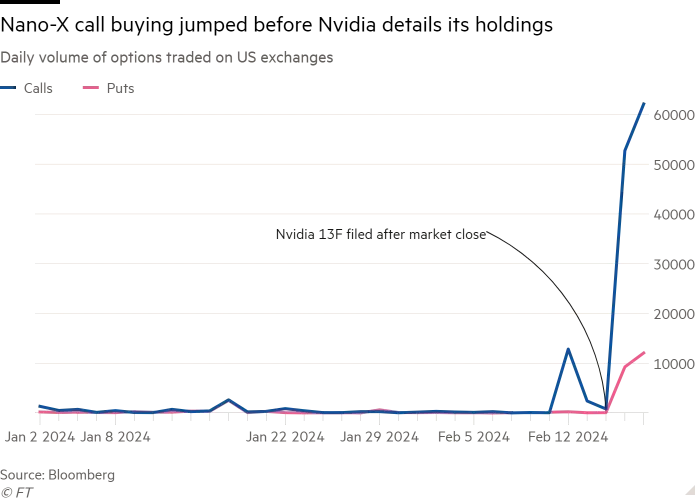

- Trading activity in Nano-X and SoundHound AI spiked with options volumes before the announcement, raising questions about market reactions and Nvidia's influence.

Traders made significant moves in the stock market last week, particularly focusing on two lesser-known companies, Nano-X Imaging and SoundHound AI, ahead of a disclosure by chipmaker Nvidia. The disclosure by Nvidia led to a surge in the shares of both companies, with Nano-X doubling and SoundHound AI rising by 69%.

The market's reaction to these developments highlighted the strong investor interest in stocks related to artificial intelligence, especially those associated with Nvidia. Nvidia's own stock has seen remarkable growth, quadrupling since the end of 2022 and reaching a market capitalization of about $1.7 trillion. The upcoming quarterly earnings update from Nvidia is anticipated to have a significant impact on the broader market's recent rally.

Traders were observed making substantial bets on Nano-X's stock through short-term options contracts just days before Nvidia's filing. The volume of call options traded for Nano-X was significantly higher than the average, with traders paying between 4 and 30 cents per contract on February 12, which later saw a substantial increase in value.

SoundHound AI also experienced heightened trading activity, with both call and put options seeing increased volumes. The market's reaction to Nvidia's stake in SoundHound AI resulted in a significant surge in the company's stock price.

While these developments reflect the market's enthusiasm for AI-related stocks, it also raises questions about potential overreactions to news and the influence of major players like Nvidia. The regulatory filing by Nvidia shed light on its investments in Nano-X and SoundHound AI, which had been held for several years but only came to the forefront due to reporting requirements.

The trading frenzy surrounding these companies underscores the ongoing interest in AI technologies and their potential impact on the market. As investors await Nvidia's earnings report, the market remains focused on the company's performance and its implications for the broader market. The regulatory scrutiny and legal challenges faced by some of these companies also add a layer of complexity to the investment landscape, highlighting the need for a balanced approach to evaluating opportunities in the stock market.

Street Views

- Henry Hu, University of Texas (Neutral on Nvidia's influence):

"Some traders appeared to have been betting that other investors would overreact to immaterial news because of the magic dust of AI."

Finance GPT

beta